2024 Market Survey Report:

Commercial EV Charging

Worries Rise About Limitations to Commercial EV Growth, but Government Incentives and Microgrids Move Charging Infrastructure Forward

To gain insight into these challenges and potential solutions, Endeavor Business Intelligence and Xendee conducted their second annual survey among leaders in the EV charging industry. This report provides insights into the survey data and takes a deep dive into the key themes, and compares them to last year’s results.

Download the 2024 Report

Electric Grid Limitations and Costs Challenges Offset by Solutions Including Microgrids and Government Incentives

A clear narrative emerged in the inaugural market survey in 2023 and continued in the 2024 survey: The high cost of developing and operating commercial EV charging projects and the limitations of the electric grid are considered, far and away, the two biggest challenges to deploying commercial EV charging infrastructure.

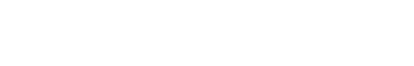

Three-quarters of respondents surveyed in 2024 said grid limitations were a “significant roadblock to the rollout of EV charging infrastructure for commercial EV usage,” while 63% tabbed the total cost of infrastructure as a significant roadblock.

While the challenges are viewed as significant, charging infrastructure stakeholders are finding effective means to solve them and move projects forward.

Microgrids and distributed energy resources (DERs) co-located with commercial EV charging infrastructure are emerging as a solution to overcome highly burdened electric grids. For the second year in a row, survey respondents said DERs and microgrids co-located with EV charging infrastructure were the most important game-changing technology for stimulating the transition to commercial EVs and fleets. Survey respondents in 2024 named microgrids, solar PV plus battery energy storage systems (BESS), and standalone BESS as the three generating technologies most important to co-locate with EV charging infrastructure.

Costs Remain a Significant Obstacle, Making Government Incentives Essential

Among the top factors that make or break a proposed EV charging project, utility grid tie-in requirements fell from the No. 1 spot in 2023 to third in 2024. When expressed as a percentage of survey respondents naming utility grid tie-in requirements as a top concern, it fell from 43% in 2023 to 39% in 2024. Availability of government incentives rose to the top concern in 2024 from second in 2023, with 45% of survey respondents naming it compared to 40% the previous year. The percentage of survey respondents who named customer demand for charging service as a top concern rose four points to 39%, lifting it to second among make-or-break factors from fourth in 2023

Microgrids: A Solution to Cost and Electric Grid Challenges

While survey respondents still view DERs and microgrids as critical technologies to overcome EV charging infrastructure challenges, a year-over-year comparison of results suggests commercial EV charging market stakeholders are learning they aren’t a silver bullet without careful planning and development.

For example, in 2023 and 2024, respondents said DERs and microgrids co-located with EV charging infrastructure were the biggest game changing technology to stimulate the transition to commercial EVs and EV fleets, but 72% named it a top three technology in 2023 compared to 63% in 2024. Taking up the slack, 28% of respondents in 2024 said “software to streamline the design of optimized EV charging infrastructure” was a top game-changing technology to stimulate commercial EV use, up 55% from the 18% of respondents who named it in 2023.

The year-over-year shift in data suggests that survey respondents continue to view DERs and microgrids as top technologies to solve EV charging infrastructure challenges, but they increasingly realize an optimal mix and configuration of DERs and microgrids is the real game changer. Simply co-locating any DER with EV chargers isn’t a sharp enough approach. Obstacles are overcome primarily during a project’s design stage, and so success is made or broken at that point. The 2024 survey results reflect this deeper realization, which highlights both the evolving complexity of projects and the value of EV charging infrastructure planning and design tools.